By Tod Ellis, PCI Associate

All lending involves risks. Lenders control risk on the front end by developing and using strong underwriting policies and procedures. Once a loan is originated, lenders use loan portfolio management to manage risk. One critical element of a strong portfolio management system is the loan review.

Key Elements of a Loan Review: PCI's Loan Review Overview explains the fundamental elements of the loan review process, including: what a loan review is, why it is important, how a Bank can use a loan review, and the steps involved in conducting a loan review.

What Is a Loan Review and Why Is It Important?

Effective loan portfolio management is crucial to controlling credit risk. In order to control risk, however, a Bank must know the types and levels of credit risk in its portfolio. Loan review is an important tool that can help Banks identify this risk. A loan review provides an assessment of the overall quality of a loan portfolio.

Specifically, a loan review:

- Assesses individual loans, including repayment risks.

- Determines compliance with lending procedures and policies.

- Identifies lapses in documentation.

- Provides credit risk management priority findings.

- Recommends practices and procedures to address findings.

- For Banks that risk-rate their loans, a loan review evaluates risk grades and their accuracy.

A thorough and correctly completed loan review provides management and the board of directors with objective and timely data on loan portfolio quality and recommendations for addressing weaknesses.

What a Loan Review Is Not

A loan review is not a portfolio review: Unlike a portfolio review, a loan review does not assess geographic, borrower, or other concentrations that can increase portfolio risk. A loan review is not a portfolio trend analysis: The loan review assesses loan quality at a specific point in time. This point is called the focal date. That said, depending on the sample reviewed, a review team may detect trends for a type of loan such as a specific industry or loan size.

A loan review is not:

- An assessment of the loan loss reserve or CECL

- A portfolio concentration review

- A portfolio trend analysis

These topics and other Enterprise Risk Management topics may be separately engaged.

How Do Banks Use Loan Reviews to Reduce Risk?

Banks use loan reviews to

- Identify issues

- Learn what modifications can be made to lending procedures, policies, and practices to address those issues.

Banks that fail to address problems early are prone to suffering from systemic weaknesses which can lead to deterioration in portfolio quality, thus reducing profitability and sustainability. If a Bank’s risk grades are used to determine its loan loss reserve, another important element of a loan review is the evaluation of the risk grades of individual loans. Additionally, if the loan review is conducted by an independent party, it can be particularly helpful in assessing incidences of fraud and theft that can directly affect the Bank’s bottom line.

What Are the Steps Involved in a Loan Review?

A loan review can be broken down into three steps:

- Pre-file review;

- File review;

- Post-file review.

Pre-file Review

Prior to the file review, the loan review team will complete two tasks.

1) Review Documents: The loan review team will review the following documents:

- Loan Policy and Underwriting Guidelines including risk grade system and loan loss reserve policy

- Watch List and Problem Loan Report

- Delinquent Loan Report

List of all loans outstanding including:

- Note Number

- Name of Borrower

- Address and tax ID

- Lending Officer

- Loan type, purpose, and collateral codes

- NAICS code

- Original Loan Amount

- Current Balance

- Available Balance

- Amount sold

- Original Note Date

- Next due date

- Maturity Date

- Number of payments

- Interest Rate

- Non-accrual. TDR, or Loan Policy exception

- Payment amount, frequency, and last payment date and amount

- Current Risk Rating

- Number of days past due and the number of times greater than 30, 60, 90 days past due.

2) Select Loan Sample: In most cases, the sampling percentage will vary based on the type of loans, the number of different loan products, and the size of the portfolio. Generally, the total dollar percentage of the portfolio reviewed should be no less than 25% for portfolios with outstanding balances up to $300 million. The percentage may be higher for smaller portfolios or portfolios with a number of different products.

A loan portfolio that consists of business loans will need a larger sample size because the underwriting and monitoring of such loans are usually not standardized. If the loan portfolio consists of a single homogenous product such as single-family residential mortgages that are underwritten in a consistent way, a smaller sample size (10-15% of total portfolio outstanding) may be sufficient.

Selecting an appropriate sample is critical: if the sample is not representative of the portfolio, the value of the loan review results will be compromised.

File Review

After determining the sample, we will develop a schedule for the file review. The amount of time spent on the file review depends on the size and the quality of the portfolio. We will send the list of loans in the sample to the Bank’s management so that they can have the loan files available when we begin work.

Documentation can be delivered electronically if off-site review is engaged. At the beginning of the file review, the loan review team needs to ensure that the management and staff of the Bank have reviewed the scope of work, including the list of loans in the sample, and understand the purpose of the file review. If needed, an orientation meeting should be held between the loan review team and the management of the Bank. At this time, the review team may provide a short list of “surprise” loans to management.

The loan review will consist of meetings with lending staff including loan administration to understand the lending process and procedures from intake to closing. The loan review team will also be reviewing underwriting and collateral files to ascertain the underwriting, monitoring, and documentation practices.

During a file review, it is common practice for a team member to meet with management or the lender to discuss individual loans. If the loan product is homogeneous and underwriting is consistent, it is recommended that the team discuss a minimum of 10% of the loans with the loan officer. If the loans are less standardized or the monitoring file documentation is insufficient, a loan review team should discuss a higher percentage of loans. A meeting with a loan officer may provide information such as specific communication between a loan officer and borrower that is not documented in the file.

The file review covers seven distinct but related areas. For each area, the loan review team evaluates adherence to the Bank’s lending policies and procedures and assesses the Bank against industry best practices. For example, a Bank may require that a loan officer only provide collateral coverage review based on the market value of the asset. A loan review team may recommend that the loan analysis also include a liquidation value of collateral since it may provide a more realistic value if a Bank takes possession of the asset and needs to sell it in a timely manner. Another example is when a Bank does not require written documentation of communication between loan officers and clients.

The best practice would be documentation of all conversations between loan officers and clients especially any pertaining to late payments. The loan review checklist contains the sections listed below.

a) Credit Initiation: Review of initial underwriting including analysis of the following: financial statements; primary and secondary sources of repayment; management; and appraisal.

b) Loan Structuring: Evaluation of repayment terms against the borrower’s ability to repay and industry best practices; guarantees; environmental indemnification; and other loan terms.

c) Loan Approval Procedures: Review of written approval procedures and policies.

d) Credit/Collateral File Documentation: Verification of all relevant initial and ongoing documentation. Review of post-closing procedures for outstanding items.

e) Normal Loan Monitoring: Verification of ongoing monitoring, as appropriate.

f) Problem Loan Management: Evaluation of problem loan management including reporting to senior management and downgrading of delinquent loans.

g) Loan Workout Management: Review of action plans and work out agreements for seriously delinquent loans.

At the conclusion of the file review, the loan review team will conduct an exit meeting with the management of the Bank to orally present their preliminary findings, conclusions, and recommendations.

Post-file Review

Following the file review, the loan review team will issue a formal report summarizing its findings, conclusions, and recommendations. An initial draft report will be issued solely to the Bank’s management for its response. Upon receipt of management’s response, a final report will be issued to the Bank. The final report will include management’s response.

Description of a Loan Review Report

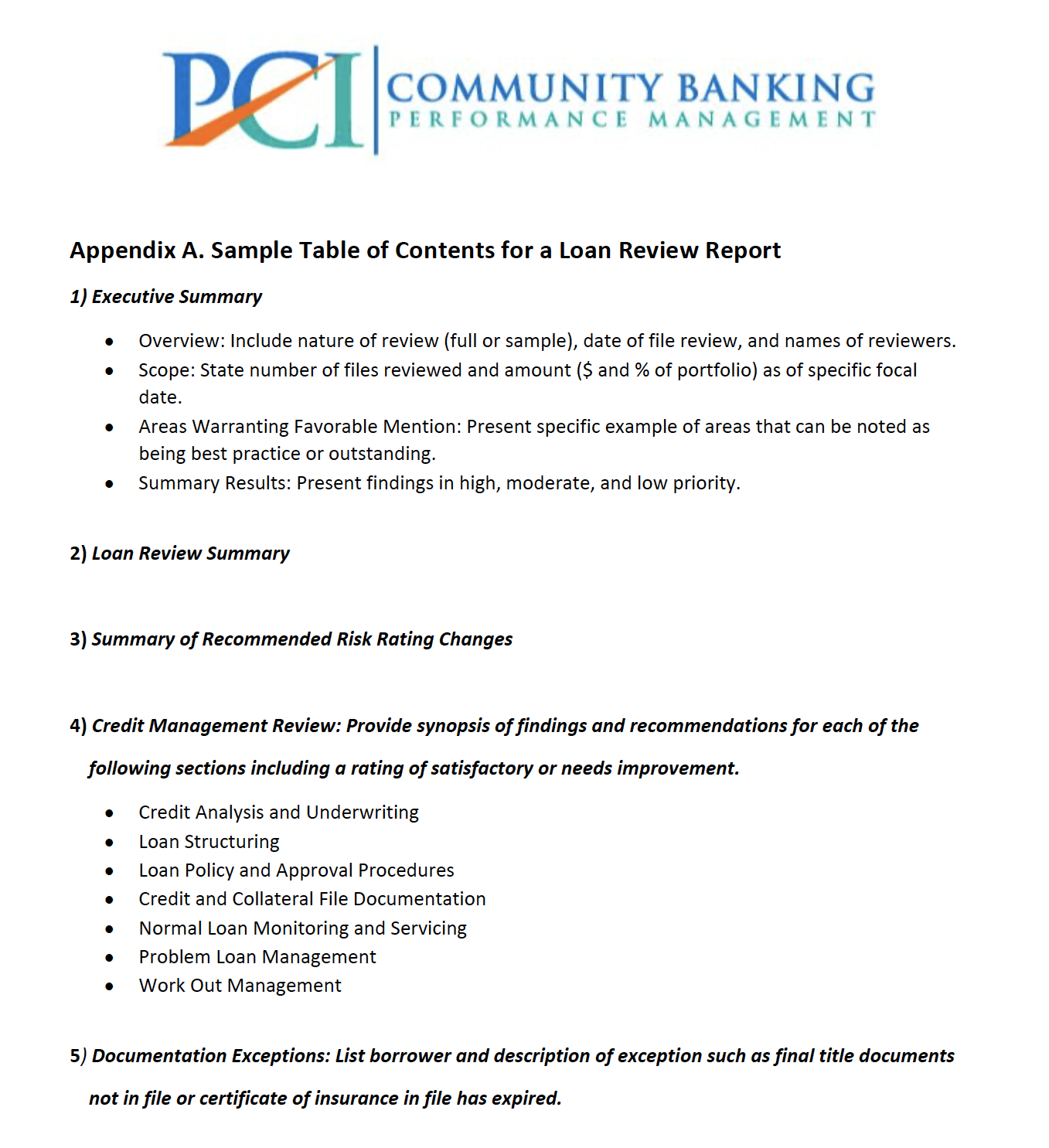

The main sections of the written loan review report are:

1. Summary Results: This section presents the findings grouped by priority level. High-priority findings are defined as violations in policy that could result in civil money penalty or loss of principal. Moderate priority findings are those that are not in line with the bank’s policies or practices. Low-priority findings offer suggestions for adhering to industry-wide best practices. The majority of the findings will be reflective of systemic issues within a loan portfolio.

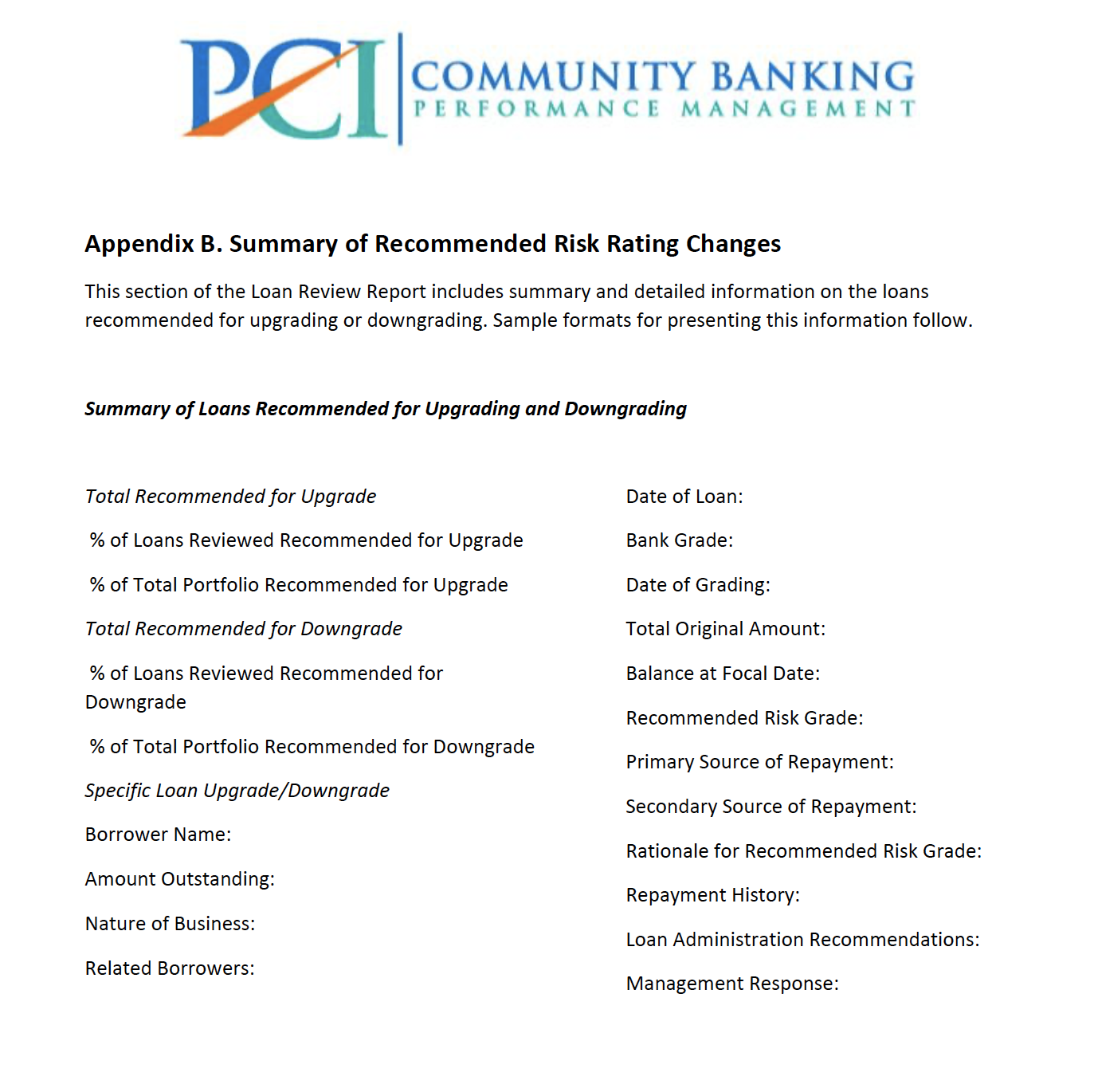

2. Summary of Risk Rating Recommendations: This section provides general and specific information for loans that the loan review team recommends downgrading or upgrading. See Appendix B for sample forms for presenting this information.

3. Credit Risk Management: This section presents the findings and recommendations by loan review checklist category.

4. Financial or Documentation Exceptions: This section is a list that outlines any specific documents (financial or other) that are missing from the files. As noted above, management is provided with a draft report. Management can provide a written response to the recommendations which will be incorporated into the final report.

Who Should Conduct a Loan Review? How Long Will It Take? How Often Should a Loan Review Be Performed?

A Bank’s risk management department or internal audit department, or a team of external consultants, can complete a loan review. The most important feature of any review team is independence. Therefore, anyone who is currently involved in the lending process including credit committee members should not be on the team. The most appropriate loan review team will have lending and credit experience. One issue with many organizations is that it may have staff who have appropriate experience but who have never completed a loan review before. The use of a consultant to lead a first loan review, select the sample, develop the loan review checklist template, and complete the loan review with the experienced Bank personnel can provide these personnel with the training and oversight that give them the capacity to confidently and competently complete the next loan review.

The length of time spent on a loan review ultimately depends on the size of the bank. On average, however, the review process from requesting the documents to receipt of the final report should take between 30-45 days. In theory, a Bank would have annual loan reviews or, in the case of large Banks, semiannual reviews. However, the cost of conducting a review may be prohibitive. Therefore, medium and small Banks may consider bi-annual reviews if the loan review reports do not indicate that there are any significant issues within the loan portfolio. Since management is to use the loan review as an assessment, a loan review with a number of medium and high-priority findings may indicate heightened credit risk and warrant a follow-up loan review within 12 or fewer months.

Most Common Deficiencies Found

Credit Initiation and Loan Structuring

- Excessive lender analysis of borrower’s management style, product concept, etc. with limited or no analysis of borrower’s financial information.

- Over-reliance on projected net income instead of historical net income.

- Lack of independent analysis of participations purchased from other institutions.

- Lack of documentation regarding physical inspection of business and/or collateral.

Loan Approval Procedures

- Lack of evidence of approval in file.

Credit/Collateral Documentation

- Lack of follow-up process after loan closing to ensure receipt of all loan documentation.

- No evidence of insurance in place (expired insurance certificate in file).

- Incorrect naming of CDFI’s role on insurance certificate (i.e., additional insured instead of mortgagee).

- Lack of a system to confirm payment of taxes and renewal of insurance policies.

- Lack of documentation regarding physical inspection of business and/or collateral.

- Late receipt of financial statements (missing or outdated financial statements).

Normal Loan Monitoring

- Lack of documentation (phone calls/visits) of monitoring by the loan officer.

Problem Loan and Workout Loan Management

- Lack of documentation of agreement with the borrower.

- Unrealistic action plan.

- The loan was not downgraded.

- Lack of evaluation of possible losses.

0 Comments